Search

Tuesday, December 18, 2007

Annual 2008 Predictions

Video Games

Microsoft will do what they normally do...rip off, reinvent and dominate. The next hot interactive video game called Thee, will feature belly dancing, Yoga, line dancing and skydiving. We all want to spend even more time indoors in front of a TV so we can avoid the interactive thing we used to call exercise and socializing.

Apple

Okay, I did predict this...kinda. Apple is now doing what analysts said they should be doing since the Mac IIe. Be a consumer electronics company. Expect more and more cool devices from Jobs and Co. that will continue to surprise their competition and delight the market. The iPhone will go on sale to match the Blackberry by March, with its next release.

Goes public in Q3 and starts aggregating successful vertical social networks that have suddenly become relevant. CPM rates, on a weighted basis, are now $15 because beacon isn't needed.

Brinker International, Outback Restaurants and Darden Restaurants

These huge restaurant companies that invented casual dining start selling their concepts like crazy. Valuations will average less than 6X trailing company-level EBITDA. Casual dining is dead. Long live casual dining.

Boutique Wine

The tail will start wagging this big dog. Small, independent wineries will start consolidating and creating efficient distribution machines that will force the big, bad ass liquor distributors to rethink, retool and reassess their value add...and futures.

Detroit

More bad decisions from stodgy, head-in-the-sand leadership will force deep discounts as Toyota continues its march to own the car world. Small is better. Remember the 70's?

Venture Capitalists

They all meet in Bali for a conference and decide to focus on funding high school students that are mentored by serial 20-something EIR's. Here comes 3.0.

To be continued...

Tuesday, December 4, 2007

The Funded

I classify The Funded entrepreneurs in two camps:

- Camp 1: Serial, successful with a track record.

- Camp 2: Not so much.

Camp 2 are pissed off because they want what Camp 1 has (had or is going to soon have).

So, what up with VC's? Well, I classify them too:

Camp 1: Tier 1 don't care. They have enough deal flow and believe that nothing original ever comes from noobs. VC's have their network and are used to being hated.

Camp 2: The rest of the VC's haven't had better than a 10% IRR anyway and are always sucking up to Tier 1 for crumbs. They don't care either. They are happy being 6th on the deal team.

So, what's the point of The Funded? You tell me.

Wednesday, November 14, 2007

Making a New Social Network Work

www.fohboh.com is a newly launched social network and business exchange developed exclusively for the huge restaurant vertical. Did you know that there are 12.8 million employees working at over 900,000 restaurants in the U.S.? That these restaurants generate over $500 billion a year in sales? Moreover, when you add vendors and service providers, over $1.3 trillion is generated. This is a big industry and the largest employer outside of the government. This I assume is why we need a restaurant vertical. So like-minded people can really socialize, share, learn, find jobs and essentially, shrink their professional universe.

www.fohboh.com is a newly launched social network and business exchange developed exclusively for the huge restaurant vertical. Did you know that there are 12.8 million employees working at over 900,000 restaurants in the U.S.? That these restaurants generate over $500 billion a year in sales? Moreover, when you add vendors and service providers, over $1.3 trillion is generated. This is a big industry and the largest employer outside of the government. This I assume is why we need a restaurant vertical. So like-minded people can really socialize, share, learn, find jobs and essentially, shrink their professional universe.FohBoh has a lot of interesting and innovative ideas on how to attract and retain millions of members (Front of the House, Back of the House, corporate staff, CXO's, vendors, suppliers and even service providers). FohBoh is focused on the business side of social networking - maybe a mix of Alibaba and Facebook. Since the restaurant industry is pretty social and very viral, it seems to be a natural.

What is also very interesting and almost counter-culture to what VC's are

looking for, is that FohBoh founders have significant domain expertise and are much older than the average 20-something's that start most of the Web 2.0 companies. My sense is that vertical SN's will have older founders because domain expertise is critical. This industry expertise (generally outside of the tech industry) is won by age. I believe that most verticals will be started by older, more experienced founders, but the communities will be managed by young online community managers. We shall see.

looking for, is that FohBoh founders have significant domain expertise and are much older than the average 20-something's that start most of the Web 2.0 companies. My sense is that vertical SN's will have older founders because domain expertise is critical. This industry expertise (generally outside of the tech industry) is won by age. I believe that most verticals will be started by older, more experienced founders, but the communities will be managed by young online community managers. We shall see.2007 marks the beginning of vertical, or niche social networks. One of the more astute entrepreneurs in Silicon Valley is Gurbaksh Chahal, founder and CEO at BlueLithium has his opinion.

____________________________

BlueLithium's CEO explains why brands and their agencies should consider niche social networks to reach a targeted audience.

When MySpace emerged victorious from the social network battle royale, marketers saw a new channel to reach an astoundingly large online audience. But while the massive reach of MySpace has proven a boon for dating sites and wireless carriers, brand marketers are still coming to grips with how best to leverage the power of social networks. Beyond providing broadcast-size audiences at a fraction of the price, some are discovering that social networks provide brand engagement at a deep level. But it's not necessarily the household name social networks that are best suited for this role.

Quantity v. quality

2007 is seeing the rise of the niche network. As noted by LeeAnn Prescott, director of research at Hitwise, in her recent report, "The social networking category will continue to grow as new sites emerge with unique offerings." Niche networks such as Kongregate, MingleNow, deviantART, and Bebo, among many others, serve a different need for consumers by focusing on hobbies, nightlife, cultures, health and other topics that a general purpose site such as MySpace can't adequately address.

Niche sites can inspire passion and loyalty among users. People don't join niche networks just because their friends are there, as often happens with MySpace or Facebook. They join them out of a genuine interest in the subject matter. Entrepreneurs start niche sites because they can't find what they want at MySpace. This should be a clue to marketers that there are other people like them who you also won't be able to reach on MySpace.

Niche networks also break through the stimulus-overload that plagues today's modern, tech-savvy consumers. With myriad different media channels and technologies from which to choose, a social network whose content adds real value to their lives is going to be chosen over simply watching TV or listening to an iPod, or even browsing on the larger traditional social networks.

And the winner is…

As a marketer, you can have an impact with your most avid users with a niche network. If the niche has a tight synergy with what you make or sell, they may even encourage you to integrate seamlessly into the content, creating a best of all worlds situation. As an integrated partner, you can do more than just branding. You can use a niche social network:

- For detailed user surveying-better than focus group research and often cheaper

- For product marketing and product ideation

- To test new ad campaigns before you run them across the web

- To build grassroots demand and "buzz" for new products or features

Which niche social network to choose? Ask your users, especially those who are particularly avid about your product. Ask your younger, web savvy employees. See what they use in addition to MySpace, Friendster, Facebook and the "Goliath" social networks.

Fundamentally, MySpace and the niche networks will each play a role, like network TV vs. a cable show on cross-stitching. Social networks are a new marketing channel; one that, when used wisely, has the potential not only to impact your marketing programs but to transform your business. Only time will tell whether David will slay Goliath, but bigger may not always be better for the marketer.

There is a lot of opportunity still for Web 2.0...hopefully, fohboh.com will keep its focus as a B2B social network and not follow others in this space as a way to connect with other bar flys.Saturday, November 3, 2007

Fresh Perspectives

Check out fohboh, the new vertical social network and business exchange beta exclusively for the huge restaurant and hospitality industry. There are over 900,000 restaurants, 12.8 million employees working in a $500 billion a year industry. This is just the U.S. and does not include hotel workers and executives.

The idea is to open this up to employees, vendors and suppliers and not consumers. It's not about reviews and making reservations. It's about business. I hope it succeeds!

Thursday, October 11, 2007

Presidential Campaign 2008 - No it's not too early

We love Thanksgiving gatherings and have promised to keep religion and politics off the menu after a family law was passed unanimously. That's a good thing.

So, being a businessman, I am of course politically agnostic...until November 2008. So the following is more of a discussion piece to solicit comments on opportunities.

As co-founder of Talktiva, one of the project [channels] we are working on is politics and their respective campaigns. We want some of that campaign money they spend on mass media to come to Talktiva. We also want to make Obama talk using a virtual Obama voice personality that uses his voice and delivers his message(s) in an interactive conversation. We intend to us advanced speech technologies, the Talktva natural language engine and scripting platform we created to make this all work. This is very cool and has never been done before. Imagine having a two way

interactive conversation with the Senator!

interactive conversation with the Senator! These represent design concepts that we plan to present to the DNC and the Obama campaign. Even a surrogate program using George Clooney as the spokesperson for Obama is being considered.

These represent design concepts that we plan to present to the DNC and the Obama campaign. Even a surrogate program using George Clooney as the spokesperson for Obama is being considered.This is untested voice technology and they are understandably nervous about untested technology. But, having said that, there are a lot of new technologies being used these days.

We have all of the top candidates listed here because really, until super Tuesday, February 5th, no one will know who represents the party.

Yes, we have a RNC palate too...I particularly like the "Ask Mitt Anything" photo.

Which designs do you vote for?

Wednesday, September 26, 2007

The Next Big Thing

So here's my short list:

#1. Bitch about how cruel the venture capital industry is an how cruel the venture process is was considered. But, that whole industry is screwed up enough with many, many venting sites. I have a lot of experience and have a lot to say about this and even have a prediction. Perhaps a few more generic blogs will occur before I transition to a SBFC (specialist blogger first class), but the teaser blog has a name...Googdaq the new market for Web 2.0 companies.

#2. The new record industry. Boy, I have great access to a lot of insiders and even invested in a start up digital media company. This is still a possibility.

#3. Restaurants. I love this industry but no one in the restaurant industry reads, so probably not a good blog concept.

#4. Becoming 50. That's an on-trend topic with a lot of curious potential readers. I have a lot of ideas, since I'm 50 and all. Things like dealing with aging parents, adult children, feeling like you're old, dealing with aches, pains, stiffness, poor eyesight, sense of confusion on career, looking for a new career, a job, feeling lonely, retirement, money, etc. Lot's of issues, lot's of information.

#5. Life lessons geared to the 18-25 year olds demographic. They are so dumb about everything except how to communicate on multiple levels using two thumbs. They can't balance a check book, cook dinner or clean a house...I could go on, and on and on...perhaps this is why this could be a good blog, blah, blah, blah. Maybe parents will visit my life lessons blog and get tips on how to related and educate and maybe kids will too. Maybe we can send the blog via SMS so they'll get it, read it and pass it on. Maybe...

I have four or five others on the short list, but these are the top 5. Well, the other is about nothing, like my current blog. Just random thoughts, original prose on things that matter to me at the moment. What do you think? What's your recommendation, 1,2,3,4,5 or give me an idea.

The Record Companies Just Don't Get It...Still

I was watching Willy Wonka the other day, the remake directed by Tim Burton (what a strange guy he is). The mom was making the best of a cabbage in a watery soup. My mind wandered to the record industry making the best of their catalog. This is their only remaining asset (surly earned fairly and squarely from every musician) and they are squeezing every last drop, because there isn't any more soup after its gone. How many compilations can we buy? How many ways can they combine the greatest hits of an old band in odd months in odd years? Creativity they have. Brains are what is missing.

I met yesterday with an industry veteran who agrees. "I see dumb people". Really, the folks in the industry are fine, it's management that can't see what everyone else sees.

So here's the deal; the record industry business model is broken, everyone knows this. The top entertainment attorneys, the top record industry chief marketing officers, the top record producers, the top talent managers, the top bands, even the starter bands. The top record executives are still expecting this Internet fad-thing to go away.

So, here's my prediction from the Bailiwick crystal Ball. Ready....stay tuned.

Sunday, September 23, 2007

Conti Estate Winery

Great fun, attitude and fabulous wines at affordable prices. I encourage you to visit them in Fair Play, Eldorado Hills County; about an hour from Sacramento.

Thursday, September 13, 2007

Rush: The Larger Bowl

This is a hit song...no doubt! Awesome tour and album. I believe that Snakes and Arrows is the best Rush album yet.

Tuesday, September 11, 2007

The Restaurant Addiction

Here's what I love about business. There is something called The Great Equalizer out there. It's a mysterious force. You can't see it. Can't buy it and in many cases, you really don't know about it until after it's become part of your life. It balances over-thinking and over-tinkering and really amazes me, particularly in the restaurant industry. Why? Here's why...

Business case #1: Smart, savvy, restaurant executive, WTF, from a public company leaves with fully vested stock options worth $5 million and intends to start a restaurant company.

In any event, he does this very entrepreneurial thing and spends months sourcing real estate, orders demographic studies, conducts focus groups, hires a consultant to write the business plan, generate a financial model and design a restaurant concept. WTF then invests $1.5 million of his own capital and $1.0 million from a landlord and opens his first independent restaurant. No corporate services to support, no national purchase contracts, no net. WTF works like a dog, calls all his former operator employees for advice and at the end of the year, has put in another $350,000, borrowed another $150,000 and is still barely at breakeven. Ugh.

Business case #2: Goofball, a former flea market vendor travels to Cabo San Lucas on vacation and sees a small restaurant and bar near the ocean with lines out the door. Goofball plants himself on a bar stool and drinks beers, eats food, talks with the bartender, customers and the hostess. Goes back to the hotel room, gets his laptop out and builds a spread on what this little shack was doing in revenue. Wow, says Goofball! I could do this, he says.

The next day, he takes a camera and completes his due diligence, including stealing a menu. Back to the states he goes. Six months later, Goofball is raising money from friends and family, hocking his condo and sets his sites on leasing a shack; and I mean a shack near the water in Laguna Beach. Burgers and beers to start...and the lines are out the door.

WTF did all the right things, and for the most part, so did Goofball. They just approached the market and built a business case differently. The Great Equalizer is a force to be embraced because start ups succeed and fail for any number of reasons. How many times have you said or heard, "man, they are successful in spite of themselves". Next time, remember they are successful because of the great force called The Equalizer.

Monday, August 20, 2007

Stormy Weather

I remember Katrina each year because without any doubt, it changed my personal view on how quickly things can change, no matter who you are. Because no matter who you are, or how careful you consider each decision you make, each time, every day, in the end, it may not matter. Because control is governed by nature. Control is a myth. You have no control over what happens in your body or what happens when a Hurricane comes to town with a bead on your home.

I spent two weeks in 2005 building a "Mash-type" restaurant and cooking for thousands of strangers where water surged over 30 feet, leaving boats in trees and houses blocks away from their foundations. I met and fed soldiers, ministers, mechanics, doctors, volunteers, police, firemen, the homeless, even FEMA. All were thankful for a hot meal on a devistated corner, where we had the only light shining. We were the new town center at Pass Christian, Miss for a bit, where friends and family would meet, check fingers and toes and rediscover the true meaning of grace.

I am truly grateful for this way-out-of-my-comfort-zone experience that I was volunteered for. It really is my personal thanksgiving day...because I remember how much a Cheeseburger with bacon meant to so many, how grateful they were to have it and how awfully good it felt to be there, doing that, for them.

Katrina changed my view of control, of loss and what matters most. If you have the opportunity to help others during a crisis, selflessly, you will never be the same person after...I guarantee it.

Volunteer

Thursday, August 9, 2007

Excuse me...I am not too old to be funded!

Click on the above link to the NY Times article.

The environment for today’s entrepreneurs is far different in a number of ways from the boom of the late ’90s.

______________________________________

Amazing...never thought it would happen but it is official, there is age discrimination in Silicon Valley and that's a fact. I hear it over and over. But people are genuinely afraid to mention it, talk about it or blog about it. True, it's their money (they actually think it's their money) so they can make any decision they want. But really, are the over 30 crowd all washed up? Are we out of ideas? Do we really not get that information super highway thing? Is it true we can't be trusted over 30? Or, are we all looking for the senior special at Denny's and a price break at the movies? Give me a break.

I'm researching this and asking anyone and everyone to collaborate on this BS. I want to write about first or even second-hand experiences with this topic. Hell, I'll take gossip. Please make this post a collaborative effort so don't just make comments. Send me your stories, and if you want, your name and a photo. This is for the over 30 crowd. The ones with experience, access, resources, ideas, capital, energy, track record, references other than a professor and an RA and a mind of our own...or is that what they are afraid of?

The venture community, at least my sampling, worries me. They all seem to have the same mindset and web 1.0 comes to my mind. Sure the environment is different, the exit strategies are less explosive and harmful, but still, not a lot of original thinking. I posted Pink Floyd's the wall from YouTube™ because this is how I see them. Start at about 2:00 min remaining and you will see my point. Even more interesting, the Wall was filmed in 1982, about the average age of the average founder of the average technology start up backed by the average VC...at least in the Valley.

Click on the following two articles for more information:

Bitch Slapping Rude

This post is about that...bitch slapping rude. The first step is being able to identify it, write about it and talk about it. Then, we may be able to recognize it and prevent it from occurring.

Object lesson

Coming home from a rock concert last night at about midnight there was a huge crowd of people jockeying for position as we exited the parking lot. While most of the drivers were lining up, a few ill-mannered folks were trying to cheat and cut in line to save 20 seconds. Horns were honking and generally, the high from the cool summer concert was lost by a few ill-mannered, rude drivers disrespecting others. Come on, get in line, relax and be courteous.

So, what's your experience?

While:

> Driving

> Shopping

> Working

> On an airplane

> Giving a presentation

> Having dinner

> ??

Monday, July 30, 2007

On Being Flakey

Here is a list of flakey infractions:

- Ignoring phone calls

- Ignoring voice mails

- Ignoring emails

- Ignoring SMS

- Not knowing how to send or receive an SMS

- Faxing documents when using email is preferred

- Forgetting about scheduled conference calls

- Scheduling meetings then ignoring calls to confirm

- Leaving a voice message without any message

- Being rude and inconsiderate

- Never sending relevant financial data

- Not having relevant financial data

- Not having any financial data

- Not having any data

I have to tell you, sourcing a deal and raising money for an acquisition is cake compared with dealing with unsophisticated sellers of businesses. So, here's my hack of the day, if you are a small business owner and have decided to sell your company, hire a consultant to manage the process so you can stay focused on running your business. M&A is hard enough when you know what you are doing. If you have any stories, please share!

Sunday, July 29, 2007

Tuesday, July 24, 2007

Financing Strategies

For example, say you're a Web 2.0 company and need $10 million to launch your business. Seed of $1 million and a proposed Series A of $9 million. That's a nice strategy, seems intelligent, designed to mitigate risk and increase valuation along the way. But wait, a Web 2.0 company is supposed to be able to seed, launch and begin aggregating users on say $200,000. Why, because most Web 2.0 companies are not particularly well conceived, well founded, or well, gonna make it. Seems the venture community all walks the same talk...show me it works, aggregate… then the money.

Well that's intelligent too, from a VC's perspective. Series A is the old Mezzanine round and Seed is the old Series A. Wait, then what comes before seed? FFCC (friends, family and credit cards). For a Web 2.0 that’s about $25,000 to 50,000, probably enough to develop a web site that has limited opportunity to succeed. If the entrepreneur is smart and very, very lucky, s/he will use free new media like Blogs, message boards, YouTube, a pitch on Vator, myspace, etc., then maybe they will attract users long enough to get a "traction" card. This traction card will be the ticket to a seed round of perhaps $500,000. You will live or die on this.

However, what if you think you’re not a Web 2.0 company and are really something else? In this case, you may have to find alternatives to the early-stage VC because they will not seed, or Series A without validation, period. And, if you need more than $50,000 to launch, then angels or project financing is the only practical solution.

Not every technology business can be started on a shoestring. Not every new Internet company will be founded by programmers that can build an Alpha site and launch a business for $25,000. What if there were bigger ideas, the ones that may actually stand on their own and not be part of the gaggle of potential Google acquisitions?

Investors need to manage risk. They have a fiduciary responsibility to their investors. Moreover, they all remember Web 1.0…so caution is a part of their DNA now. But, I think they are missing out by being too safe. Seems to me that an investment strategy that sprinkles a few hundred thousand on a bunch of ideas that may actually work enough to either be sold to a portfolio company and exit at a 2X or a larger media company at a 5X+ is too safe and boring. If I were a VC, I’d manage my portfolio differently. Perhaps a few sprinkles here and there, but I would not follow the herd. I would look for the big idea, the one that needs more capital and doesn’t have “traction” and won’t until $10 million or more has been spent. Big ideas are what made the valley. If all they do is look for little bitty web 2.0 companies to sprinkle a couple of hundred grand on and then sell, then where is the next BIG ASS company going to come from? Not from Silicon Valley, that’s for sure.

So here’s the tip: If you are a Web 2.0 fine, have fun, but you will need $25 to $50 thousand and a boat load of registered users and some idea of how to monetize that before you are ready to present to early-stage VC’s.

If you are not a Web 2.0 start up, think big. Look for strategic partners/investors and either project finance or raise a very large amount of money from investors that understand your business. If you look for seed at a VC, you will be wasting your time. Know who you are before you start.

Tuesday, July 10, 2007

Mergers and Acquisition

Over the past 10 years my partner and I have looked at well over 100 opportunities just in the restaurant industry. These operating companies generally have similar characteristics including number of restaurants operating in the chain; concept, sector, EBITDA margins and geography, among others. The interesting thing to note is that the common dominator regardless of size is how painfully slow the process, is that any deal can fail anytime during the process.

Bailiwick Consumer Group became a fundless sponsor about two years ago. We specialize in the lower-end of the middle market targeting chain restaurant acquisitions. Great business. Intellectually stimulating, financially rewarding (at least on a pro forma basis) and fun. It is also expensive to play.

So here’s the process:

Sourcing and qualifying

You better have some domain expertise and a full time job that actually pays you because it could take years…and years. Leverage clients, associates, professionals in legal and accounting as well as smaller investment banks. Get on their list of potential buyers. Also, if you like a business, initiate the call yourself to the owner. You should attend trade shows and conferences and subscribe to newsletters. Be in the business that you target.

Once you find an opportunity, qualify, qualify and qualify. Not just the business, but qualify the willingness of the seller to actually desire to sell the business. Qualify their understanding of the process, their flexibility in pricing and the hard work it will take to get to a close. Patience here is critical. You may find yourself doing a bit of missionary work as well as educating the seller on the ways of M&A. That is okay though, because you are building a relationship that will benefit the transaction.

Initial Due Diligence

This is relatively painless and shouldn’t take too long. But it can and usually does! In our experience, we only look at chains…restaurants with at least $3 million in EBITDA. So, we need to see financial statements for each restaurant for the preceding 12 months, a summary of all real estate leases and line item detail of corporate overhead or G&A. That’s it. The goal here is to determine what Company-level EBITDA is and evaluate the sum of the parts…ID the dogs if you will. If we have this data we will either proceed with a LOI or pass.

Letter of Intent

The LOI is generally non-binding and the purchase offer is subject to due diligence and should always include a standstill agreement to conduct financial, business, concept and management team diligence for a reasonable time frame. This locks up the deal so you can feel comfortable spending money and time evaluating the purchase and securing equity and debt financing. In some cases, the owners will ask for a deposit to be escrowed and applied to the purchase price. This shows good faith on the buyer’s part while providing a cash if the deal doesn’t close under the terms of the LOI. I will never do that again. Big mistake. Excuse me, but I am spending my money and my valuable time accessing your business to determine if I will write a big check. This is the part that always gets a little testy, especially if there is an investment bank or sellers’ agent involved. But, make sure the standstill is in place.

The LOI for a chain restaurant purchase is based on the trailing 12 months financial statements, so getting the most recent 12 months data will be like pulling teeth.

Thorough Due Diligence

We always try to get 60 days for due diligence, provided all requests for documents are delivered to us within 10 days of such a request. This never happens, so we generally have a lot of time to review the company. Then, we need 60-90 days to close…secure capital, work with lenders and equity partners to expedite their diligence, etc. So here we are at about 120-150 days not including delays on the sellers side. There is still no assurance the deal will close during or after diligence is completed.

Last year we identified a target, locked them up, secured LOI’s from a lender and a blue chip equity partner for 105% of the capital required to complete this transaction. At the last minute the equity partner decided they were clairvoyant about pricing and pulled out. We had to replace them…while negotiating a reduction in value of at least $2 million. This where some skill in negotiating will be valuable. The reduction was based on what we discovered during our investigation. Okay, we are now into this deal $50,000, 60 days into diligence, plus 45 days to get to the diligence period, so 105 days and we have no firm price and no equity partner. Essentially we have no deal. The bad news is that we are nearing then end of our exclusive period. This is a long story, but suffice it to say, we lost our deal 45 days later. Total time, 150 days, total cost in time and cash $150,000. In another posting I will elaborate on how to negotiate a fundless sponsor package with your capital partner.

Revisions, Revisions, Adjustments and Definitive Agreement

If you can get here, you are near to closing a deal. This where the real money is spent on legal, financial reviews in some cases audits, facilities inspections, real estate valuations, etc. Still, there is no assurance the deal will close.

Closing

Many times you will never get there and in some cases, it will be anticlimactic, after so much time. However, once the LOI has been replaced by a definitive agreement and escrow is open you are near the end. Now, there are a lot of details that take place between executing the documents and official transfer, but this blog entry is just about the process.

Challenges

On a small transaction, one less than $50 million, the financials, believe it or not, will be generally sloppy and the CFO, or VP Finance will not have experience in M&A. So, education and patience will go a long way to making a deal happen. The more you inure yourself to ownership, the more likely you will get to a close and less likely there will be a need for an auction. Always seek a negotiated transaction because bidding decreases the odds especially for a fundless sponsor.

We are in the process now on a new transaction, so I will keep you posted.

Saturday, June 23, 2007

BAILIWICK QUATTRO

I took organic chemistry three times, way back when and failed miserably all three times. This changed my life. So, instead of trudging off to UC California at Davis with the goal of becoming a Enologist, I when into the restaurant business. I figured I would drink it and serve it if I couldn't make it. But no more. Finally, good things do take time. My handle has been Bailiwick and/or Bailywicks since 1981 when I opened my first restaurant called Bailywicks and I have always loved the name and the definition. The 1848 California Gold Rush inspired us.

Bailiwick Quattro will be made in Fair Play, California. It will be a unique and elegant wine of distinction. Gold was discovered in California not far from where our grapes are grown. Today, the gold-rush soil and balmy Sierra Nevada climate in the foothills, serve to create the ideal growing conditions. Then, we filter our silky and spicy superior red wine through Gold, with a little left to help Bailiwick age in each bottle.

Our grapes are picked and crushed by hand and aged in American Oak. Cabernet Sauvignon, Merlot, Cabernet Franc and California Gold, are combined to create B A I L I W I C K Quattro. We plan to sell this luxury red wine blend for about $125.00 retail. If you are interested in futures, I can arrange for that.

Bailiwick Defined

Thursday, June 21, 2007

Now It's Getting Exciting

See talktiva for more information.

Monday, May 21, 2007

Santana Row

Okay, here’s my first review.

The Village California Bistro and Wine Bar. This French-wannabe has a great location and a lot of promise. But, management needs more awareness. Details are everything…

- Seated at a table with no salt and pepper shakers

- Caesar salad with no Caesar dressing or Parmesan cheese

- Cold and hard Au Gratin potatoes…this really sucked and I had to return them

- Empty water glasses...frequently

- No lime wedge with my Tanqueray…that’s just wrong!

- A Tanqueray and tonic in a Tom Collins glass...what's up with that?

- Forgetful foodserver

Okay, I think I was nice while casually reminding her that she forgot…on numerous occasions, basic table service and had zero eye for quality assurance. Then she said "you guys must eat out a lot, huh."

On the plus side, the food was above par (other than the potatoes…my favorite kind and the sole reason I chose this restaurant) and the floor manager was attentive.

I have three words…focus, training and execution.

**

(out of five)

Wanna TalkToSanta™?

Imagine calling a phone number and a cute little Elf answers and says “hello, who’s calling?” You say “it’s Bob, is Santa there?” The Elf says “hi Bob, sure, Santa’s here. But first, where are you from?” Whoa!!! A talking Elf and I’m having a conversation with this talking Elf? What’s next?

This is very cool. In fact it’s a mash-up of advanced automated speech recognition software and other cool technologies integrated by TALKTIVA Voice Entertainment Network. They have invented a new conversational voice interface that will enable consumers to have conversations with personalities. They are starting with Santa…so stay tuned.

In about a month, I’ll post a phone number so you can try it. So, leave a comment with your email address and you can beta test it…very cute and a great gift idea for any believer.

Monday, April 9, 2007

Google is Big Brother!

Hello,

Thanks for your report. We apologize for any confusion or inconvenience.

For your security, we may temporarily disable access to your account if

our system detects abnormal usage. It will take between one minute and 24

hours for you to regain access, depending on the behavior our system

detected.

Abnormal usage includes, but is not limited to:

- Receiving, deleting, or popping out large amounts of mail (via POP) in a

short period of time

- Sending a large number of undeliverable messages (messages that bounce

back)

- Using third party file-sharing or storing software, or software that

automatically logs in to your account and that is not supported by Gmail

- Multiple instances of your Gmail account opened

- Browser-related issues. Please note that if you find your browser

continually reloading while attempting to access your inbox, it is likely

a browser issue, and it may be necessary to clear your browser's cache and

cookies.

If you feel that access should not have been disabled, please visit

https://mail.google.com

troubleshooting tips.

Sincerely,

The Google Team

Okay Google Team, here's my Sector 6...Bye Bye for good. I am back to Yahoo!, remember Yahoo!, they are the company that is worth $100 billion less than Google...for no good reason!

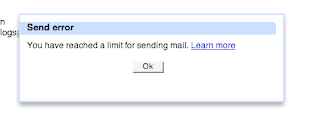

So, after a while Google let's me receive email, then I get this error?

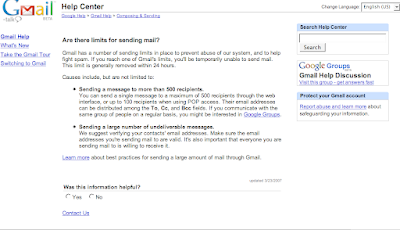

So, after a while Google let's me receive email, then I get this error?And, then this bullshit expla

ination...

ination...Saturday, March 17, 2007

Signed vs. unsigned artist

This line is blurred now and will completely disappear in a matter of years...as should DRM!

So, I suggest that all independent artists sign themselves. Manage your own destiny, own your content and hire a manager to do what the "labels" did...before the Internet.

- PR

- Tours

- Production

- Distribution

With MySpace, CD Baby, night clubs, Internet radio...and soon Embarka's Music Agent™, why wait?

Are David Bowie, James Taylor, White Snake, or Rush waiting? They know the game and have embraced the business side. It's not the "Man", it's your business. If you think just playing gigs or writing songs and putting out an album is what this business is about you are naive. So, sign yourself, leverage the Internet and the forces of change to exploit your career. You do not need to be signed…sign yourself and use this awesome new change agent called the Internet, MySpace and Embarka’s Music Agent™ widget to reach your full potential.

Embarka Digital Media

Clearly, this is my favorite pet project that has been amazingly difficult to fund. Maybe I just haven't found the right audience. But, Embarka has evolved nicely and is on track in spite of our bank balances. We have shifted the business strategy from being a destination web site (like all other web sites) to one that will be syndicated. This Embarka Music Agent™ has been designed to go with the artists...wherever they go physically or virtually. It's our backend and their music. It's our shopping cart and payment gateway, and their music. We promote them to clubs and enable them to book gigs online. This powerful little application is exactly what every musician, or any artists for that matter needs to run their business. It sits on their web site or blog, even MySpace profile and never, ever leaves their web site. It makes them money, manages their fan base, connects them with other artists while working behind the scenes as their virtual gig booking music agent.

This powerful tool set is set to launch as soon as Embarka has 2,000 beta testers signed up…It’s free! So…go to www.embarka.com to sign up to be a beta tester and help launch this cool tool!

Interactive Voice Response (IVR) Technology

A new mobile technology that serves you…using natural language and speech recognition…

…in a natural voice that learns and takes direction from you…

…your web personality…on your telephone, laptop, PC…

…wherever you go…working for you and on behalf of you.

10 years ago General Magic kind of tried this with Portico. Stay tuned, I have a bit of interesting and exceedingly exciting news about a start-up called Talktiva. This Company has a killer IVR application and is expecting to "stun" the mobile telephony world with their controversial IVR technology.

Tuesday, February 20, 2007

Reality Bites

The songs they select are dated and lately all sound like a commercial for Michael Jackson…remember him? The contestants are as rough as they can be. Is this some weird attempt to show a before and after photo of how Idol can make barely talented common folk rock stars?

Host Brian is surprisingly, normal this year. He tends to comfort the verbally and emotionally whipped wannabe stars and asks nearly closed-ended and simple questions after each performance. This reality bites.

Tuesday, February 13, 2007

Widgets are everywhere

Yup, another technology bandwagon...

These powerful mini applications are fast-tracking a new way to advertise, connect and transact business. Watch out for a cool, newly evolved approach to help embarka race to become the leader in the new music business. So, here's our version...I can't wait for this baby to be up.

Here's the plan: Everybody wins... Got it!

Tuesday, February 6, 2007

Morphing can be a great thing

Case study:

SnapX, a code name for an idea that has morphed so many times the only thing left is 50% of the original name. But, that's a good thing. The founder's original vision was a good idea not a big/great idea. Over a year has gone by and only one of the original three founders remains. And, only about 10% of the original idea remains too. New founders, bigger idea, better team, better timing and now it may just be a great big idea than can be financed.

Being a patient technology start-up is an oxymoron. But the reality is, in most cases, the amount of time it takes to bring an idea to market is exactly the right amount of time. Rush it and it will likely be the wrong idea, managed by the wrong team and launched at the wrong time. Ideas, like cake, need time to bake. The team must take the time to vet the concept, conduct research, take surveys, write the concept paper...again and again. Change the revenue model...again, and again. Add excited advisors...then remove them for lack of enthusiasm. Hire an attorney and a fund raiser, then fire them both. Change the name, the logo, the color, buy then sell office furniture and write the business plan...again and again and again...

Long before an idea is ready to present to the world, it must twist, change, bleed and morph into something great; otherwise it's just a good idea. The world doesn't need another good idea.

Monday, February 5, 2007

Focus and execute

Whatever happened to being able to focus and execute? Being focused requires one to not multi-task. Focusing means putting what you are working on at the center of your attention. Once you have focused on this one thing…then execute. Simple?

So, I did an experiment. After catching myself talking on the cell phone and sending an email with my Blackberry…while driving from

I think we should pace ourselves a bit more, leave the cell phone and Blackberry in the car once in a while, and try to focus and execute a little more too.

Friday, February 2, 2007

Greedy Bastards

Thirty-nine billion dollars and change is what Exxon make in 2006. That's $39,000,000,000. Of course it's a record...beat 2005 handily. Something has to change and I am not talking about saving a few cents per gallon. I'll gladly give that up if we can focus on the ball. The big blue ball called Earth! When is congress going to go to work? I've totally given up on Bush, so has the 70% of American and 99% of the world. But, really, we have to leave something for the kids don't we?

We have debt and we have global warming to leave them. I could go on but it's depressing.

Focus people! Global warming is not a concept it's a fact and we are screwing up the environment. We need some help here with our elected officials. What is about Washington D.C.? As soon as our freshmen congressmen and women take office they forget who they represent. I thought we were in charge here.

Going green is intelligent, mandatory and critical to our survival. The environment better be a big part of the forthcoming campaign in 2008. If any candidate accepts money from Exxon, s/he will lose my vote. Greedy Bastards!

Please take a few minutes and write your representative.

Just click here...hey, it could work!: Please protect the environment.

Wednesday, January 17, 2007

Apple, Inc.

I went to high school with Steve. Okay one wish… I wish I had been nicer to Steve and stayed late in electronics class and became friends with him and Woz. Who knows, maybe I could have been an early employee at Apple. Employee 99, that, would have been cool. But no, I had to do the water polo thing for the girls and anyway, I had zero interest in technology...boring!

We all make mistakes. We all make decisions that we can't reverse and, at one time on another wished we could go back to a certain date for a do-over. I have few of those. One in particular is related to stock options and how fast they go up...and down! But that’s a long story.

Making good decisions and learning from that; accepting responsibility and being accountable for whatever may result is a key life success factor. That's maturity. Wishing is like making hope a strategy, dumb! Wishing is a waste of time. I wish I could get a date. I wish I had a better job. I wish I had more money. I wish George Bush would make a good decision. Stop wishing and start doing. Take some action…it’s 100% up to you.

Dreaming is a good idea though. It helps bring clarity to what you want and visualizing is absolutely the right thing to do. However, hoping for a result that favors you or anyone else is a waste of time. Instead, take action, make good, thoughtful decisions and live with the outcome...good or bad. You will make good decisions. You will also make bad decisions that affect your life for years...deal with it. Learn from it and make better decisions and, never look back because you cannot change anything, only learn and grow from it.

Making decisions carefully does not mean be indecisive. A decision not to make a decision is a decision… not to make a decision...really! You can’t help but make decisions, even if you’re a procrastinator.

Apple, Inc. made a decision 2 1/2 years ago to make an Apple phone. They denied it, distracted all of us, avoided announcements and put huge penalties on anyone that leaked. But here we are, with the Apple iPhone ready to sell beginning in June. They still don't have ownership of the name... not that owning the brand name before a big marketing push is important. Only Apple and Steve Jobs would make that decision. I do find the decision to announce a name change interesting though. Apple, Inc. just told the world that computers will be just part of their product mix in the future...not their only product. I for one welcome the new Apple, Inc. as a consumer products company melding technology with digital media. Walt Disney, Henry Ford, meet Steve Jobs.

Thanks Steve…I wish we could have been friends ;)

Tuesday, January 16, 2007

Turning 40

Turning 40 is indeed a right of passage. Forty is 10 more than 30, 10 less than 50. Kinda like a teenager of middle age.

Generally at forty, you are not anywhere near where you expected to be...geographically, financially, physically, mentally, spiritually or creatively. It's a time to reflect…gez, how pedantic. No, really, it is a good time to take a moment. It’s a good time to think about who you are, who your friends are and re-evaluate what you stand for. It’s a good time to count your blessings and be grateful for what you have, not wallow what you don’t have. It’s a good time to defend your position and assess your first 40. Set new goals, make new friends, and purge that database of meaningless relationships in favor of your new social and business network. Create a profile on MySpace and Linkedin...could be fun! Commit to taking better care of your body, your mind and your spirit and start eating better. Exercise more, read more and drink more red wine. Call your parents more and send a real card through the mail once in a while, and not just at Christmas. People really like that.

I dreaded my 40th. I didn’t get my Porsche. I survived. My wife is turning 40, she doesn’t want a Porsche…imagine that! Kim’s cool though. She looks 30 but is 40. She’s a breath of fresh air. She’s honest, kind to strangers, healthy, happy, and isn't afraid to tell people what she thinks. Happy birthday sweetie, enjoy the next 40.

Sky Diving Over New Zealand

energy. I love the mountains and the spirit of the mountain men and women...hardy, appreciative, genunine and huggy. But, I miss the traffic, the long hours, the deals, the congestion. How sick is that? Well....I also miss the restaurants, the intelligence, the creativity and the money. Fine, I admit it, I miss the money and the deals. Did I say I missed the reataurants? Having worked in NYC and San Francisco, I may be more of a city person than I thought. But the move.

energy. I love the mountains and the spirit of the mountain men and women...hardy, appreciative, genunine and huggy. But, I miss the traffic, the long hours, the deals, the congestion. How sick is that? Well....I also miss the restaurants, the intelligence, the creativity and the money. Fine, I admit it, I miss the money and the deals. Did I say I missed the reataurants? Having worked in NYC and San Francisco, I may be more of a city person than I thought. But the move.Time to purge the junk that comes with owning a large home. How many CRT monitors does one really need to have in the garage? The bigger the home...the more stuff you have. The smaller the home, fewer things are needed. I like that. Small, simple, less stuff. This makes sense. So, there is good to come from this. But the planning and logistical nightmare that comes with moving and purging isn't enjoyable. The fact is, moving sucks. So, that's why I would rather be skydiving over NZ than preparing to move. Stay tuned...

Saturday, January 6, 2007

I'd rather raise $50 million than $1 million

It is true though. Raising $50 million from institutional investors is easier than raising $1 million from small private investors. Why? Funds are required to invest and need to talk to guys like me. Angel investors don't. Having said that, the informal angel marketplace is huge and plays a big role in our economy. By the way, our economy is run by small business.

They're just hard to find and generally not in a hurry to write a check. But they do write checks and it is a numbers game.

Howard Shultz, the Chairman of Starbucks, said that he presented to over 278 angel investors when he was starting out. 217 said no. So, on one of my projects, I've only presented to 75, then the Holiday's got in the way and slowed that down. I figure I have 142 more to go before I'm done! If I do 5 a week it will only take me 28.4 weeks, or slightly more than 1/2 a year. No worries. If it's that good of an idea, that market will wait, right?

So, here's a big thank you to America's small investors that accept risk and believe in the possible. No risk, no reward right? So give back and fund an entrepreneur today. It's just money. After all, money is a renewable resource... time and opportunity aren't. One a day is all I ask!

Dining at Michael Mina's In San Francisco

I would love to have the writing talent of a Michael Bauer, the famed SF Chronicle restaurant reviewer. But I don't. So, suffice to say on a scale of 1-10, with 10 being the highest, Michael Mina delivered a 12. We were fortunate to experience a hand picked seven course-tasting menu accompanied with a delicious wine paring. They delivered unbelievable food, excellent wine selection and extraordinary service.

Thank you Brian and especially Michael...you've got this fine dining thing down...so, what's next?